(Part 1)

This article discusses how to post PPP and SBA loan income and expenses into QuickBooks, if using separate bank accounts for the funds you receive.

By opening a separate bank account at your bank will allow a clear audit trail when you are requesting your loan be converted to a grant.

We will first add a Long-Term Liability account in QuickBooks. Then we will add the new bank account.

For QB Desktop: Chart of Accounts | (Ctrl+N) | Other Account Types | Long Term Liability | Continue

Account Name: PPP Funds | Save & Close

For QB Online: Accounting | Chart of Accounts | New | Account Type: Long-Term Liability | Detail Type: Loan Payable OR Other Long-Term Liabilities

Account Name: PPP Funds | Save & Close Read More

Create a PPP Bank Account

For QBD: Chart of Accounts | (Ctrl+N) | Bank | Continue

Account Name: PPP Bank

For QBO: Accounting | Chart of Accounts | New | Account Type: Bank | Detail Type: Checking

Name: PPP Bank

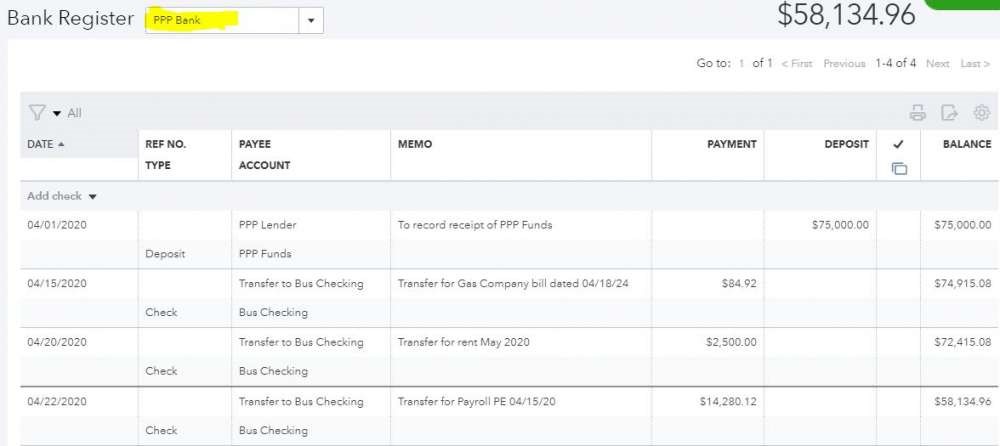

Record the PPP Loan Income

1. Setup Loan Vendor

Verify you have a Vendor setup already for the name of the lending institution who processed your loan. If this lender is new to your business, setup the new Vendor.

2. Deposit Loan Funds

Make a Deposit to your new PPP Bank. Do this if you are using QBD or QBO; don’t wait for the bank feed – manually enter the deposit so it will be a QBO Match.

Received From: Enter the Vendor name of your lender from step 1 above

From Account: Enter the new Other Current Liability or Long Term Liability Account you created above

Memo or Description: To record receipt of PPP Funds

Be sure to enter the correct deposit date and deposit amount.

Create a New Vendor in QB

If you are a regular reader of my Blog posts, you will know I’m not fond of the QB “Transfer” feature. Instead, I suggest you write a check to record transfers between bank accounts. To do this, setup a new Vendor, if you don’t already have one in place.

For QBD: Vendors | Vendor Center | (Ctrl+N)

Vendor Name: Transfer to Bus Checking -xxxx

Where the -xxxx is the last 4 digits of the business checking account number.

For QBO: Expenses | Vendors | New Vendor | Company (and Display Name as) Transfer to Bus Checking -xxxx

Where the -xxxx is the last 4 digits of the business checking account number.

Recording Expenses

Use the regular Business Checking account to pay expenses as per normal. But after payment of each expense, make a transfer (using the Write Check feature) from your PPP Bank back to your regular business checking account as reimbursement for the allowable expense. Move the funds in real life, and in QB.

For example: If you pay a utility bill during the covered period for $84.92 from your regular business checking, then make a transfer from your PPP Bank to your Bus Checking for $84.92. Continue these one-for-one transfers until all the PPP funds are used up.

If your online banking allows you to add a memo or description on the online banking funds transfer screen, add a short but meaningful description. Example: “PPP Transfer for electric bill” or “PPP Transfer for Payroll PE xx/xx/xx”.

Tip: Do not combine a transfer for utilities and for payroll in a single transfer; do a separate transfer for each – one transfer per expense. Use your judgement on what does make sense to put into a single combined transfer. This combination makes sense: payroll wages + payroll taxes. This combination does not make sense: Payroll + Utilities + Rent in a single transfer. Instead, make three separate transfers.

Tip: When writing the transfer check, be sure to delete any Check number (leave that field blank).

Tip: Be sure to enter the Memo/Description in what I call both the Upper and Lower memo fields, as one Memo field displays on reports and the other Memo fields displays in the Register.

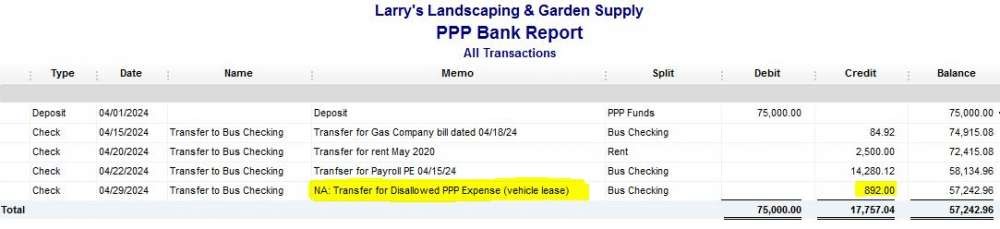

QBD Register Screenshot

QBO Register Screenshot

Reporting

This method keeps a clean trail of PPP Income and Expenses. However, it will not show the spending from your new PPP Bank by expense type, like on a P&L report. To obtain a spending report, you can create a custom report, but keep in mind you may end up later transposing this data to Excel for loan reporting purposes. This method also avoids Class tracking, to which you may or may not have access depending upon your QuickBooks subscription.

QBD Report

Go to: Reports | Custom Reports | Transaction Detail

Customize Report

Display Tab:

Dates: All Dates

Report Basis: Cash, even if your business is on the Accrual Basis

Filters Tab:

Account: PPP Bank

Header/Footer Tab:

Report Title: PPP Bank Report

Remove columns you don’t want on the Display Tab, or by dragging on the report screen.

In the example below, we removed Class, Clr, Account and Original Amount.

Click (Ctrl+M) to Memorize the report.

This report still does not show a breakdown by spending category, but it is easier to print than the Account Register view.

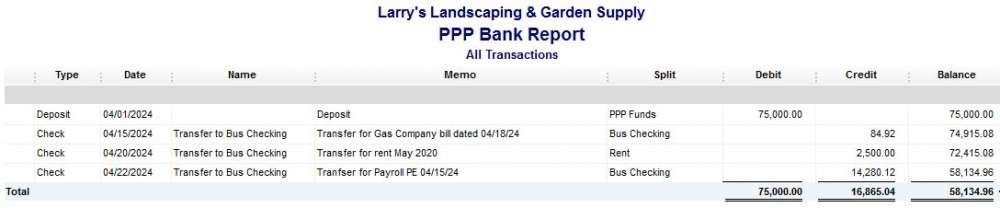

QBO Reporting

Click on Reports

In Search Bar enter: Transaction Detail by Account Report

Customize

Report Period: All Dates

Accounting Method: Cash

Rows/Columns: Change Columns

Remove: Amount, Num, Split

Add: Debit, Credit then drag order to this:

Debit

Credit

Balance

Filter: Distribution Account | PPP Bank

Header/Footer: Report Title: PPP Bank Report

Run report

QBO Screenshot: Memorized Report

Should You Change Your Payroll Bank Account to Your New PPP Bank Account?

At this point, we recommend not doing so. Some non-allowable expenses might be included in your payroll run, such as payments to Independent Contractors, payroll fees, and reimbursable expenses.

We think it’s better to do a manual calculation of what is allowable for each payroll run, and then transfer that specific amount. Of course, save complete details your backup calculations (most likely an Excel file), and of your payroll reports.

How to Track Spending for on Non-Allowable Expenses

You can spend PPP funds received on non-allowed expenses but know those expenses won’t be forgiven – you will have to repay them, along with loan interest. The PPP loan must be repaid within two years, the interest rate is a low 1 percent. The lender must defer all payments of principal, interest and fees for at least 6 months, up to one year. All in all, it is quite an attractive loan.

You can track these expenses the same way, just add a notation in your Memo/Description field, such as an “NA” to start the description, like this: